Be your own financial manager

Many of us are struggling with our finances. We never have enough money while wondering where it went. This gives a lot of stress and can even keep us awake at night. I think it’s unnecessary and unhealthy to live this way and that’s why I’m challenging you to become your own financial manager. To help you with this process I’m sharing my easy financial rules with you:

Many of us are struggling with our finances. We never have enough money while wondering where it went. This gives a lot of stress and can even keep us awake at night. I think it’s unnecessary and unhealthy to live this way and that’s why I’m challenging you to become your own financial manager. To help you with this process I’m sharing my easy financial rules with you:

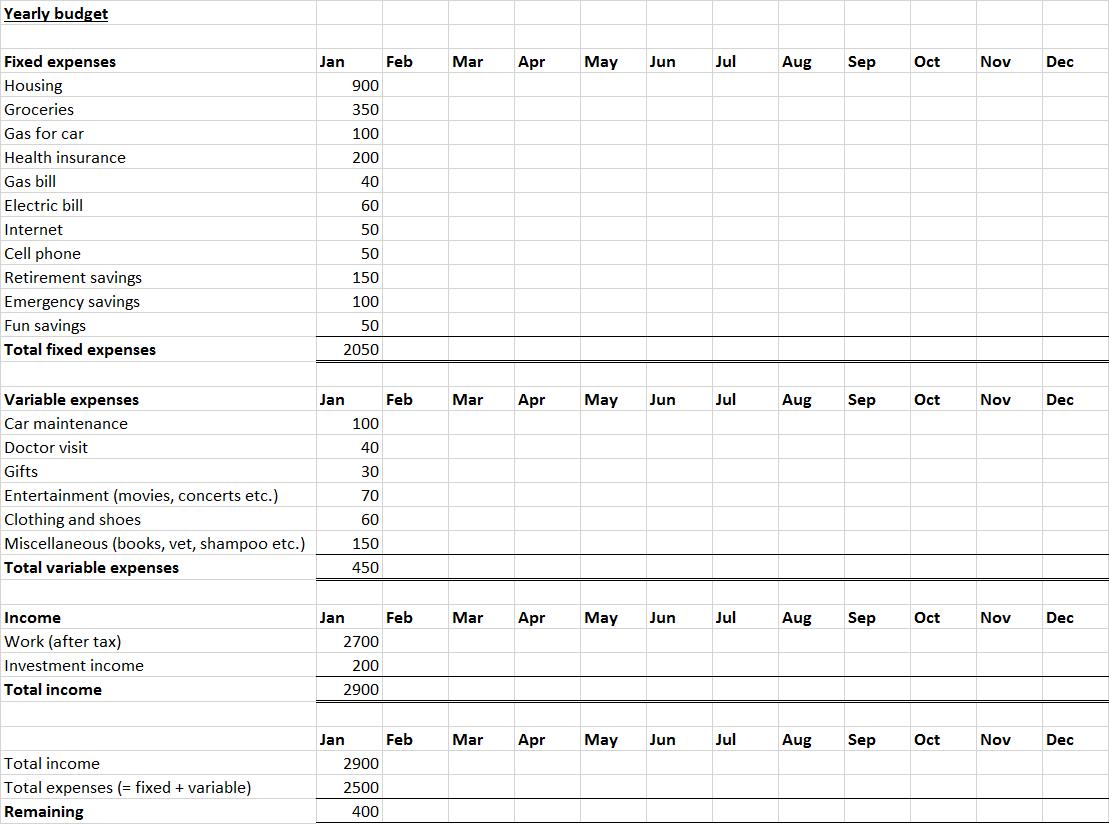

- Make a yearly budget e.g. in excel. The budget includes 1 year and is divided in 12 months. In the budget you write down for each month your fixed expenses, variable expenses, income and the remaining between your income and expenses. It may look like this:

This way you get an overview of your monthly income, expenses and the remaining.

2. Check the actual expenses and income after each month and compare them with your budget.

- In case the remaining of a certain month is negative, adjust your variable expenses or increase your income in the following month. This way the negative remaining doesn’t accumulate to become unmanageable.

- If your remaining is positive then balance the overdraft of a previous month, transfer it to a savings or deposit account, increase your retirement savings and/or invest in e.g. stocks.

3. Check your payment account(s) daily so that when something goes wrong, e.g. an unwanted collection has taken place, you can take immediate action on it. This way you don’t forget about it and your money doesn’t disappear without you knowing whereto.

4. Save monthly by using an automatic transfer on the day that you receive your salary/income. An advice is to save 10% of your income, but when this isn’t possible any amount is better than nothing at all.

5. Don’t spend more than you receive. By making a budget you know exactly how much you can spend. To avoid unnecessary spending ask yourself before buying: Do I really need this or do I want to buy it because I am emotional (bad mood, sad etc.)? If it’s the latter, face the problem and solve it in an appropriate way.

6. Use your credit cards only when you have no other options left. Remember that they are loans with a very high intrest rate. The best thing to do is not to have them at all. You can’t use what you don’t have. Instead of using a credit card, save money to buy what you want. This is how it was done in the past and it’s the best way to keep you out of money trouble.

7. Pay off your loans as soon as possible. Even if you can’t pay a lot at once, keep on paying until all your loans are payed off. Not having debts makes you a free person who can live a relaxed life and have a good night sleep.

8. Don’t pretend as if your finances are not your business. You’re an adult and you have to take care of it. Who else is gonna do it for you? Managing your finances means managing your life to more freedom and happiness! Who doesn’t want that?